Property managers’ top tips for renters

To help renters get a better idea of how to prepare the best rental application, we surveyed dozens of property managers about what they’re looking for from potential tenants.

Based on our survey results, here are some of the most important things that property managers are looking for when they need to fill a rental suite.

Make a good first impression

When speaking with a potential landlord, it’s important to make a strong impression right off the bat. What’s the best way to do it? Here are the top responses from our survey, and the percentage of property managers that said each:

- Complete the application completely and accurately (50%)

- Be polite and friendly (31%)

- Be punctual (8%)

As you’ll notice, completing the application in full is important—landlords want as much information as possible when choosing the right tenant for their rental unit.

Provide strong supporting information

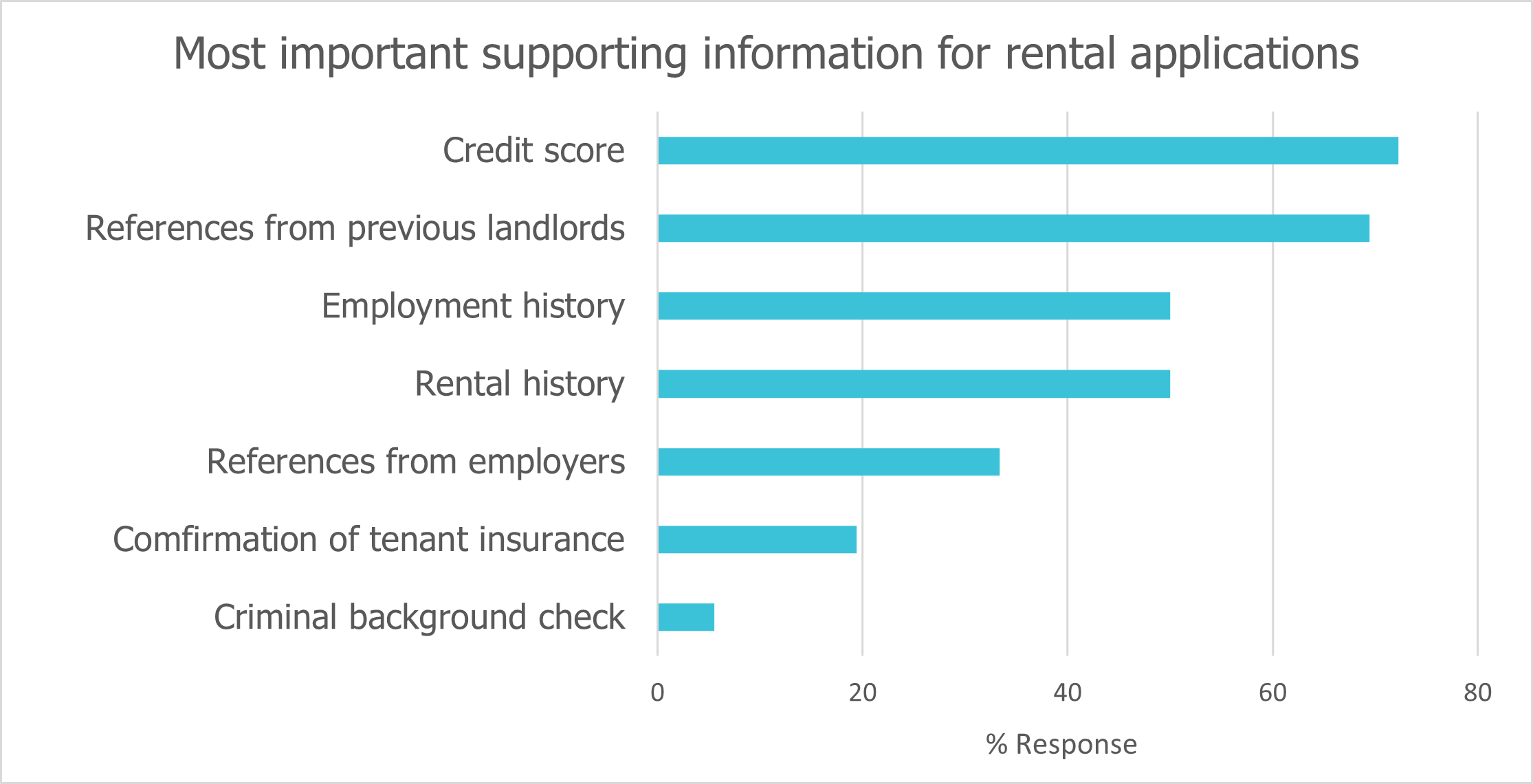

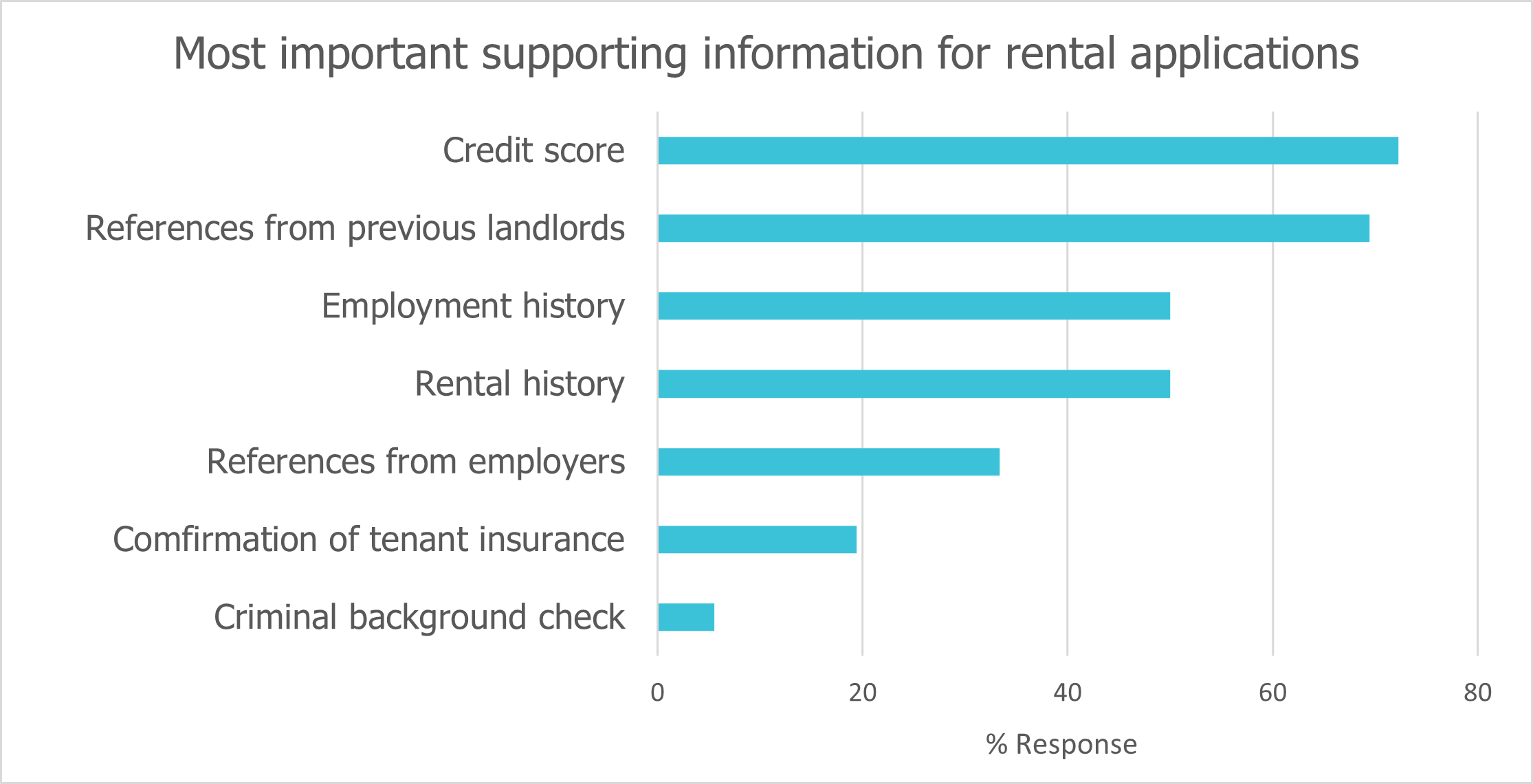

As mentioned, landlords and property managers may ask for references, credit checks, or other supporting information to help them decide whether to rent to someone or not.

Here’s how property managers responded when asked for their top 3 pieces of supporting information:

It’s clear what most property managers want to see: strong credit, stable employment, and good references. It makes sense, as a respectful tenant who pays the rent on time is their end goal. But what happens if you know your credit check or employment history won’t hold up? You don’t need to automatically disqualify yourself.

“No one is perfect and people face roadblocks throughout their life,” says Cheung. “Be transparent, explain your situation, and people will appreciate your honesty!”

Similarly, it’s possible to overcome a lack of references from previous landlords.

“References from both professionals and friends can be helpful,” says Cheung. “This can range from your accountant, former teacher, sports coach, or your neighbour. Similar to a job interview, someone who can speak on behalf of your character would be helpful.”

Avoid red flags

The survey respondents noted several potential red flags that might give them a reason to pass on an otherwise solid application. Here are the most noted rental application red flags, and the percentage of property managers that included each in their response:

- Low income or unstable employment (42%)

- Incomplete or inaccurate application (39%)

- Low credit score (33%)

- Short or missing rental history, or frequent past moves (31%)

- Offering to pay rent in advance (8%)

- Criminal record (6%)

- Having a pet (6%)

Now, some of these are hard to get around. But, as noted above, as long as you’re aware of your own red flags, you can be transparent about them and offer explanations. It won’t always work, but honesty goes a long way—it’s better than lying and starting the relationship off on the wrong foot.

Try to stand out

In a tough rental market, there can be dozens or hundreds of people competing for each rental unit. Like a competitive job market, it’s helpful if you can do something to set your application apart from the crowd.

“Have some fun with it,” says Cheung. “Take the time to provide a brief introduction and more information about yourself.

“Don’t be discouraged if you were not selected for a property. Landlords only have the ability to select one application unlike a company doing a mass hire so don’t be put off by the process.”

Ready to tackle the rental market?

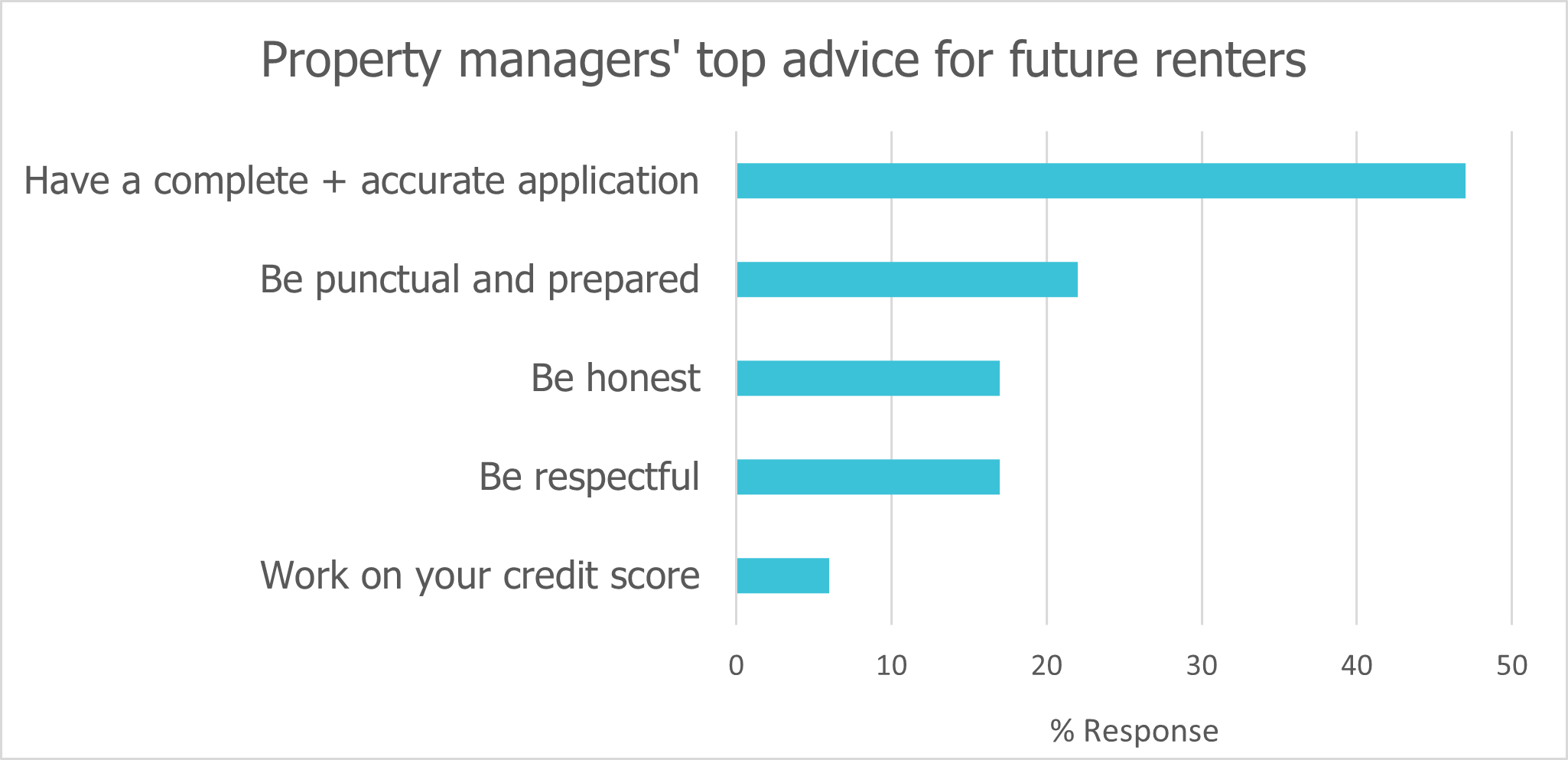

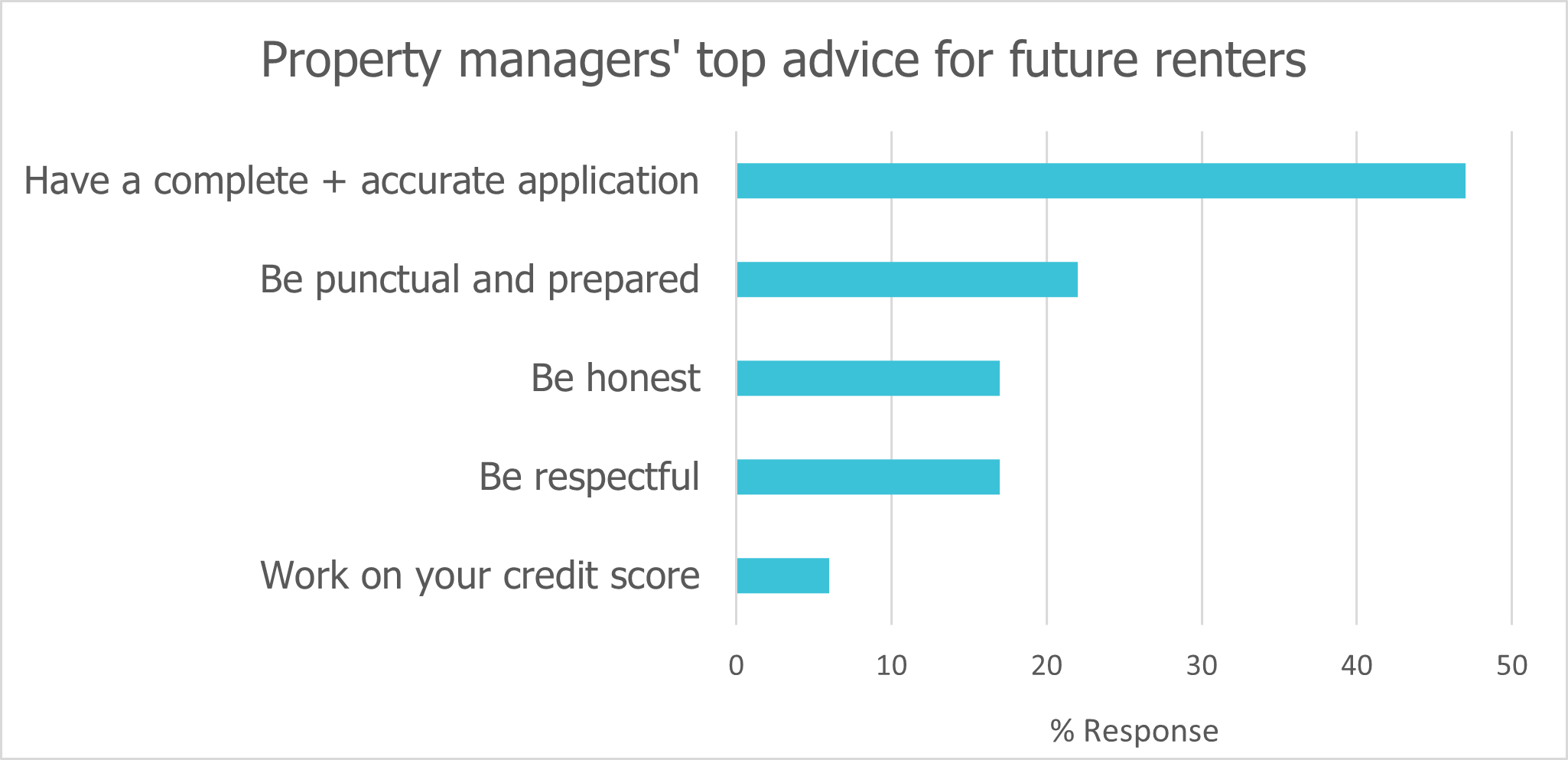

When asked to offer one piece of advice to future applicants, here are the most common bits of advice the survey respondents offered:

Buying tenant insurance

As a tenant, there are many reasons to purchase tenant insurance. Firstly, to protect your own personal property kept in the rental unit—that’s basically all the stuff you own, from your couch to your television.

Plus, tenant insurance can help cover your liability if a visitor, for example, slips and falls in your apartment. And, you’ll also have coverage for additional living expenses if you have to move out of your apartment due to an insured loss.

Tenant insurance can also cover certain types of accidental damage you may cause to the unit itself. For example, if your faulty toaster oven starts a fire that damages your unit and complex, you may be responsible for that damage. Tenant insurance is also used to defend yourself if someone slips and is injured at your premises.

Many landlords actually require you to provide them with proof of insurance before they allow you to move in. In fact, over 80% of the property managers from our survey said they do.

If you buy tenant insurance from Square One, we can even forward a confirmation of insurance right to your landlord. Whether you’re a tenant in BC, Ontario, or any other province, tenant insurance is a good idea.

Commonly asked questions

What is a credit reference on a rental application?

A credit reference is a way for a landlord to gauge an applicant’s financial situation, especially their ability to make consistent, on-time rent payments. Normally, a credit reference is in the form of a credit report from a firm such as Equifax or TransUnion. Alternatively, a landlord may accept documentation like bank statements or paystubs.

What are some common reasons a rental application gets denied?

Common reasons for a rental application to be denied include poor credit, a lack of references (or poor references), or a past eviction. It could also be that your application was received too late, or that you have a pet and the landlord would prefer pet-less tenants.

How long does it take for a rental application to be approved?

The length of time it takes a landlord to approve an application varies depending on the landlord and how many applications they received. Often, it takes between 1 and 5 days for the landlord or property manager to review all the applications, contact references, and make a final decision.

Watch the full video

Want to learn more? Visit our Renter resource centre for more tips and information about life as a renter. Or, get an online quote in under 5 minutes and find out how affordable personalized home insurance can be.

About the expert: Nina Knudsen

Nina Knudsen has 12 years of property management experience under her belt. Nina is part of the team at Royal LePage Sussex, bringing her experience to the company’s Property Management division as the Managing director of the Hello Rent team.