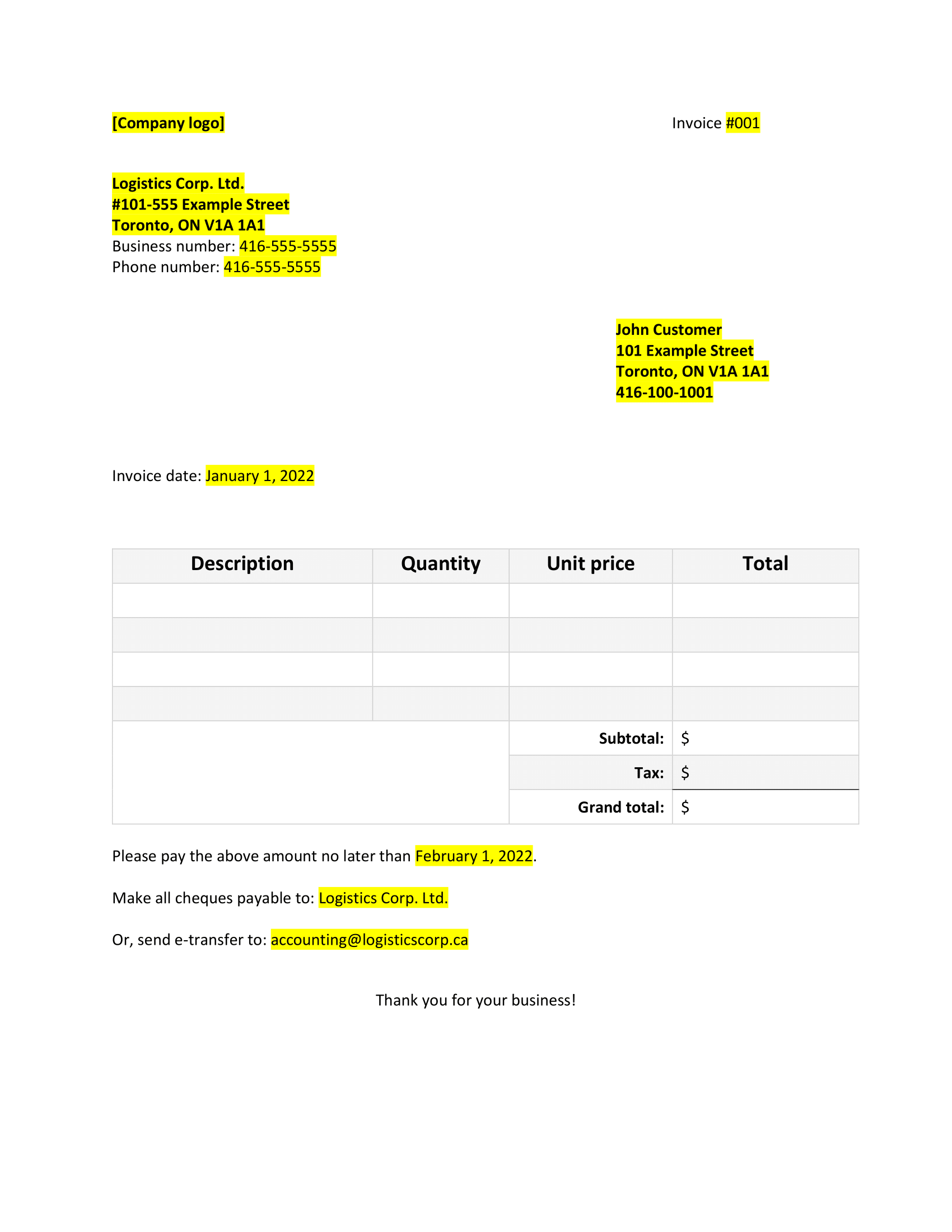

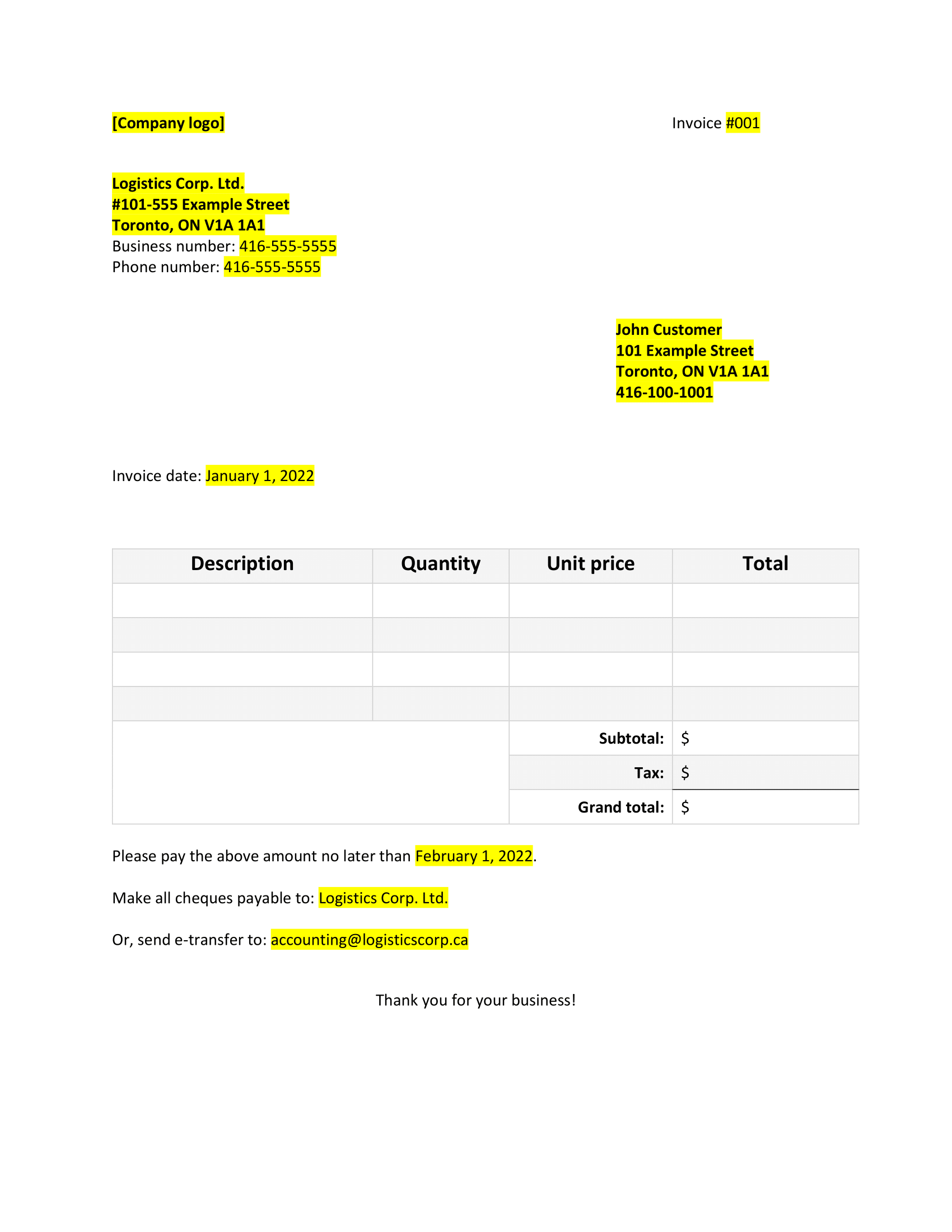

Downloadable invoice template

Feel free to use this downloadable formal invoice template. Please note that the content of this document is for informational purposes only and has no legal value.

Download template

We all receive them, we all (hopefully) pay them, and we don’t like them… Yes, we are talking about invoices!

If you’ve never had your own business and you’re not self-employed, you probably have never had to create an invoice of your own.

On this page, you will find a downloadable invoice template to help you get started. You will also find a quick rundown on how to create an invoice and when to use it.

Feel free to use this downloadable formal invoice template. Please note that the content of this document is for informational purposes only and has no legal value.

ready for an online quote? Your time matters, and so does your stuff. Get a personalized home insurance quote in 5 minutes. That’s less time than it takes to wait in line for coffee.

Before you start, please review our Privacy Policy and Terms of Use.

In accounting, an invoice (sometimes called a bill) is a document displaying a list of goods or services charged to a client, as well as the sum payable by the buyer to the seller.

Any legal entity (for example, a corporation) performing a commercial transaction is obligated to create an invoice, no matter the amount of the transaction. The invoice document sanctions the delivery of a good or service in exchange for a payment. Depending on the terms of the invoice, the payment may come before or after the service is rendered.

Any legal entity (like a private company, a government agency or a self-employed worker) can create an invoice for goods or services rendered.

An invoice must include the following elements:

You can send your invoice electronically or print it off and send it by mail.

Sending your invoice electronically offers a number of advantages: your invoice won’t get lost, it saves you and your customers time, you don’t have to worry about paying for envelopes and postage, and you help the environment by saving paper.

Since taxes vary across Canada, you will need to check with your provincial tax authority to see what taxes apply for your invoice.

A pro forma invoice is used by companies as a preliminary sales document that is sent to the customer before the merchandise is expedited. A pro forma invoice will include the following information:

Looking for more helpful templates? Visit our Template resource centre to find ready-to-use templates for a range of important documents. Or, get an online quote in under 5 minutes and find out how affordable personalized home insurance can be.

Check out these related articles:

Get a personalized online home insurance quote in just 5 minutes and see how much money you can save by switching to Square One.

Even when you take precautions, accidents can happen. Home insurance is one way to protect your family against financial losses from accidents. And, home insurance can start from as little as $15/month.